TAMPA, Fla. (WFLA) — In late March, thousands of senior citizens blocked the entrances to the country’s biggest banks in a nationwide climate protest. These advocates are frustrated with banks for helping to fund fossil fuels.

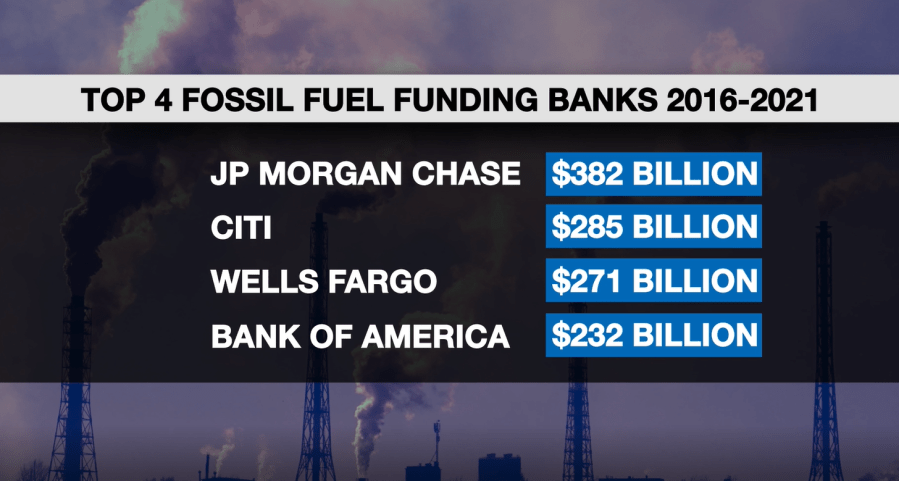

A 2022 report from the Rainforest Action Network found the top four fossil fuel funders are all US banks, and since the Paris Climate Agreement in 2015, they’ve spent well over a trillion dollars underwriting fossil fuel projects.

As a result, some in the climate concerned community are moving their assets away from the big banks, toward banks with a more friendly environmental footprint.

So WFLA’s Chief Meteorologist and Climate Specialist Jeff Berardelli went to visit a pioneering bank right here in the Tampa Bay Area, named Climate First Bank. It’s been operating since 2021.

Berardelli spoke with the CEO of the bank, Ken LaRoe. He’s on a mission to help the World through ethical banking, “I’m an environmental guy, my passion is the environment and the climate.”

LaRoe was born and raised in Central Florida with a love for nature. But he’s watched with concern as Florida’s population boomed and its environment busted.

Climate First – the second green bank that he’s owned – is one of the few “values-based banks” in Florida, with a focus on the environment. LaRoe contends it’s not just good for the world, it’s good for business.

“It sounds like you are saying that running a company ethically also has a financial advantage,” asks Berardelli. LaRoe answers, “Totally, for hundreds of reasons.”

He feels his customer base is growing because they walk the walk. The bank gives 1% of its proceeds to environmental charities and offers an aggressive solar loan program. But it’s what they’re not doing that resonates most with the climate concerned.

“We have a negative filter or an exclusionary list. We don’t do fracking. We don’t do dirty energy. We don’t do extractive industries which in Florida includes sod farming and water bottling,” explains LaRoe. “We just won’t do it. We won’t touch it. It’s not good for the environment, it’s not good for the planet. We are not gonna do it.”

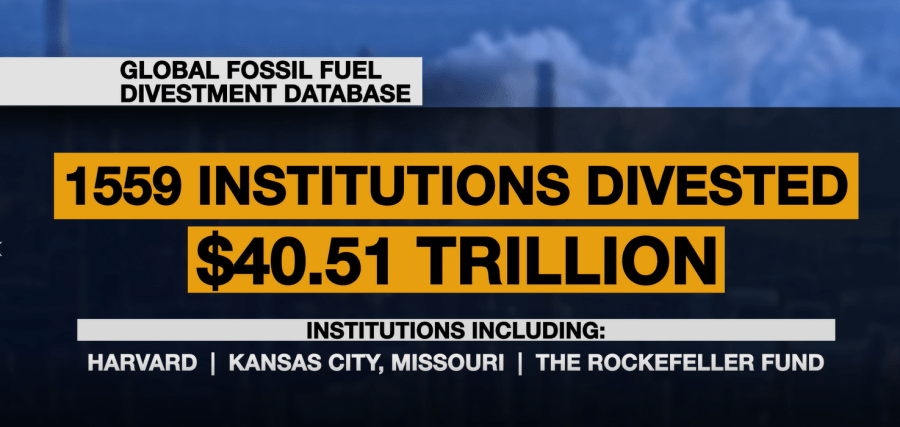

Customers switching from big banks to banks like Climate First are part of a nationwide divestment – or vote with your wallet – movement. The idea is that if people and organizations stop trading fossil fuel investments, it will hasten the transition to cleaner energy.

To date, organizations have divested over $40 trillion from fossil fuels, including universities like Harvard, cities like Kansas City, Missouri and ironically the Rockefeller Fund, a fund originally built on oil.

It is worth mentioning that many big banks are working on being more sustainable by investing funds into climate and sustainability initiatives. With that said, the world’s 60 biggest banks’ financing of fossil fuels has remained relatively constant since 2016, with more than $700 billion invested each year.

Whether the divestment movement is working or not is up for debate, but just like so many other social issues, it has become controversial in partisan circles.

“It is unfortunate that the environment has become such a divisive issue when we all depend on it for our survival, exclaims Berardelli.

“Crazy,” says LaRoe. “I think about the analogy of horses. They will only poop in one part of the pasture – a very small confined part of the pasture. They know not to fowl where they eat, yet we are supposedly the smartest and we fowl everything that we eat and everything we drink and breathe. It doesn’t make any sense.”