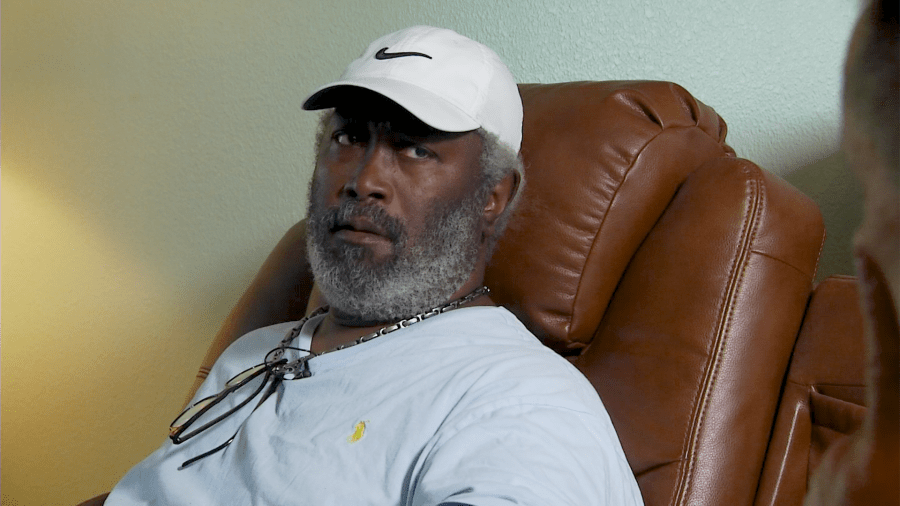

BRADENTON, Fla. (WFLA) — A disabled veteran’s long fight to keep his Bradenton home seemed to come to an end Thursday when the Department of Veterans Affairs was granted possession of the property.

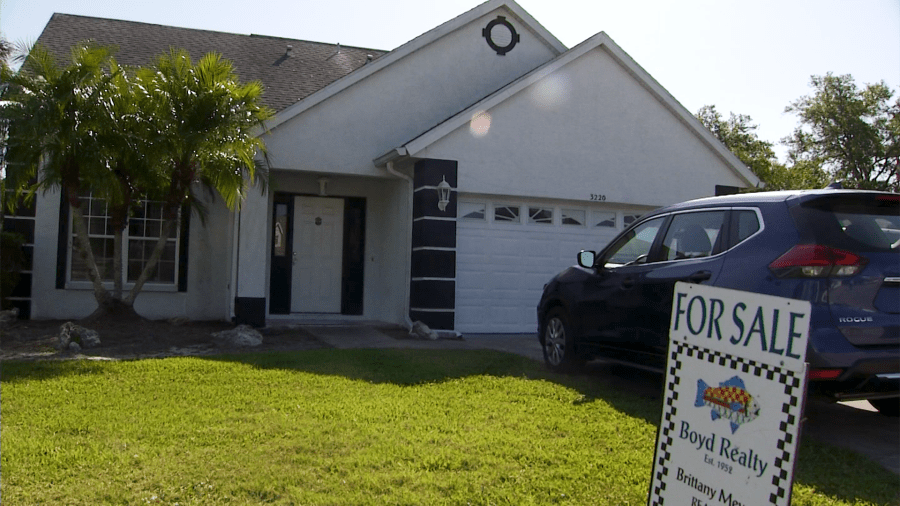

The complex maze of paperwork for John McKenzie’s mortgage includes a long list of lien holders since he used a VA-backed loan to buy the home about 20 years ago.

McKenzie and experts who worked on his case claimed the VA was not one of those lien holders.

Records show several of the banks involved with property over the years went under during that period of time that included the 2008 banking crisis that sent many mortgage companies into bankruptcy.

McKenzie, who suffers from various health conditions related to his service in the Army, said he did not receive any notifications when his mortgage was sold and claims he did not know who to pay.

“I haven’t been mailed anything. Believe it or not, it’s been very tough on me,” McKenzie said. “My health and emotionally.”

McKenzie hired title researcher Donna Steenkamp and filed paperwork to stop the foreclosure last year.

But Thursday morning, his chance to stay in the home where he raised his children ended when a Manatee County judge granted a Writ of Possession to the VA.

Steenkamp said she understands why someone would say McKenzie had to know he should have been paying somebody to keep the home, but she insists there is more to the story.

“The whole crux of this is John had no idea who to pay. There was nobody to send his money to,” Steenkamp said. “Basically, the loan went into the ether somewhere and nobody came after him for 20 years.”

McKenzie said he did not know about the problem until he tried to move out last year after his health condition stopped him from walking up stairs and forced him to live exclusively on the first floor.

One of McKenzie’s court filings claims the true owner of the mortgage is the Government National Mortgage Association, a federal entity better known as Ginnie Mae.

The court record includes a affidavit from expert witness William McCaffery who asserted “there is no recorded transfer of ownership from the named Ginnie Mae Trust to the Secretary of Veterans Affairs..”

That and other evidence was not enough to stop the foreclosure.

While the VA could now be cleared to sell the 2,000 square foot home for a projected $400,000, McKenzie and Steenkamp insist the agency with the $374 billion budget did not lose any money on the loan.

“Not one single penny,” Steenkamp said. “I’ve got four recorded conversations with VA officials around the country that state the VA has no record of this loan. There’s been no payments. There’s been no claim.”

The VA responded to a request for comment about the case but so far has not provided a statement.

Mckenzie’s house was under contract briefly last year. New York-based Cerberus Capital eventually backed out of the purchase for undisclosed reasons.