TAMPA, Fla. (WFLA) — The federal moratorium on evictions, instituted by the Centers for Disease Control and Prevention, ends on Saturday. With the end of that protection, hundreds of thousands of Americans, including more than 144,000 Floridians, could be at risk of becoming homeless.

The eviction moratorium ends on July 31, as the U.S. Supreme Court ruled against any extension not created through legislation or by Congress.

Local governments may still put their own moratoriums in place.

“Given the recent spread of the Delta variant, including among those Americans both most likely to face evictions and lacking vaccinations, President Biden would have strongly supported a decision by the CDC to further extend this eviction moratorium to protect renters at this moment of heightened vulnerability,” the White House said in a statement. “Unfortunately, the Supreme Court has made clear that this option is no longer available.”

While the virus continues to sweep through the states and infections rates are on the rise, Florida Gov. Ron DeSantis continues to fight against even the concept of lockdowns, mask mandates, or other state-issued coronavirus restrictions.

Risk of eviction as delta spreads

A recent eviction forecast study by Zillow estimated that 481,630 eviction filings could be filed once the moratorium ends. From those 481,630, the company projected that 261,945 would be evicted.

In Florida, the Zillow forecast estimates that in Florida, 144,220 households that rent their homes or apartments may be at risk of getting evicted. According to the same study, 7.4 million households are already behind on rent, as of July, according to the U.S. Census Bureau’s Household Pulse Survey.

Here are the stats Zillow provided for the state of Florida:

- 357,194 renter households in Florida are currently behind on rent, 48,969 less than in June.

- It’s estimated there are 144,220 renter households currently at risk of eviction, 9,879 more than last month.

- Factoring in added uncertainty, Zillow projects there will be 22,411 eviction filings in Florida and 12,376 are likely to result in eviction.

Zillow estimates more than 3 million renters who were employed in March 2020 were still jobless in November. The company says unemployed renters in the U.S. will typically spend 43% of their unemployment income on rent alone.

The most recent Household Pulse Survey reports 540,664 Floridians are behind on mortgage payments, and 357,194 are behind on rent payments. The data also shows that the same number of residents not caught up on rent payments are worried they’ll have to leave their homes in the next two months due to eviction.

The Treasury Department released a July 2 publication noting while more people were receiving assistance, states and local governments must do more to help those in need.

The ERA program report prepared by the Treasury Department showed that only 160,000 households received financial assistance in May.

Now, concerns over evictions have not improved as the end of the eviction moratorium drew closer.

Coronavirus concerns are on the rise again

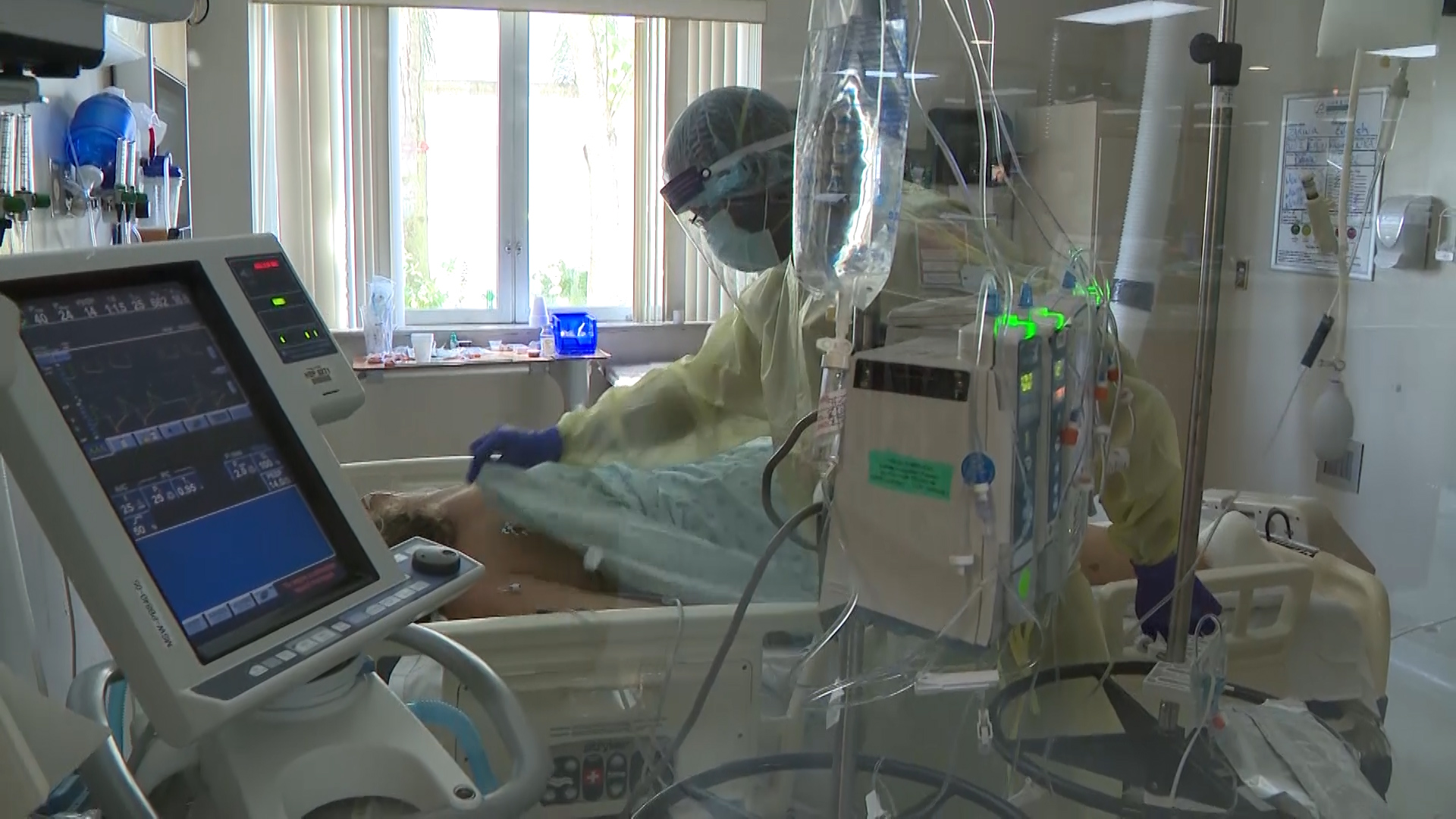

Meanwhile, the delta variant of COVID-19 continues to spread among the populations of each state.

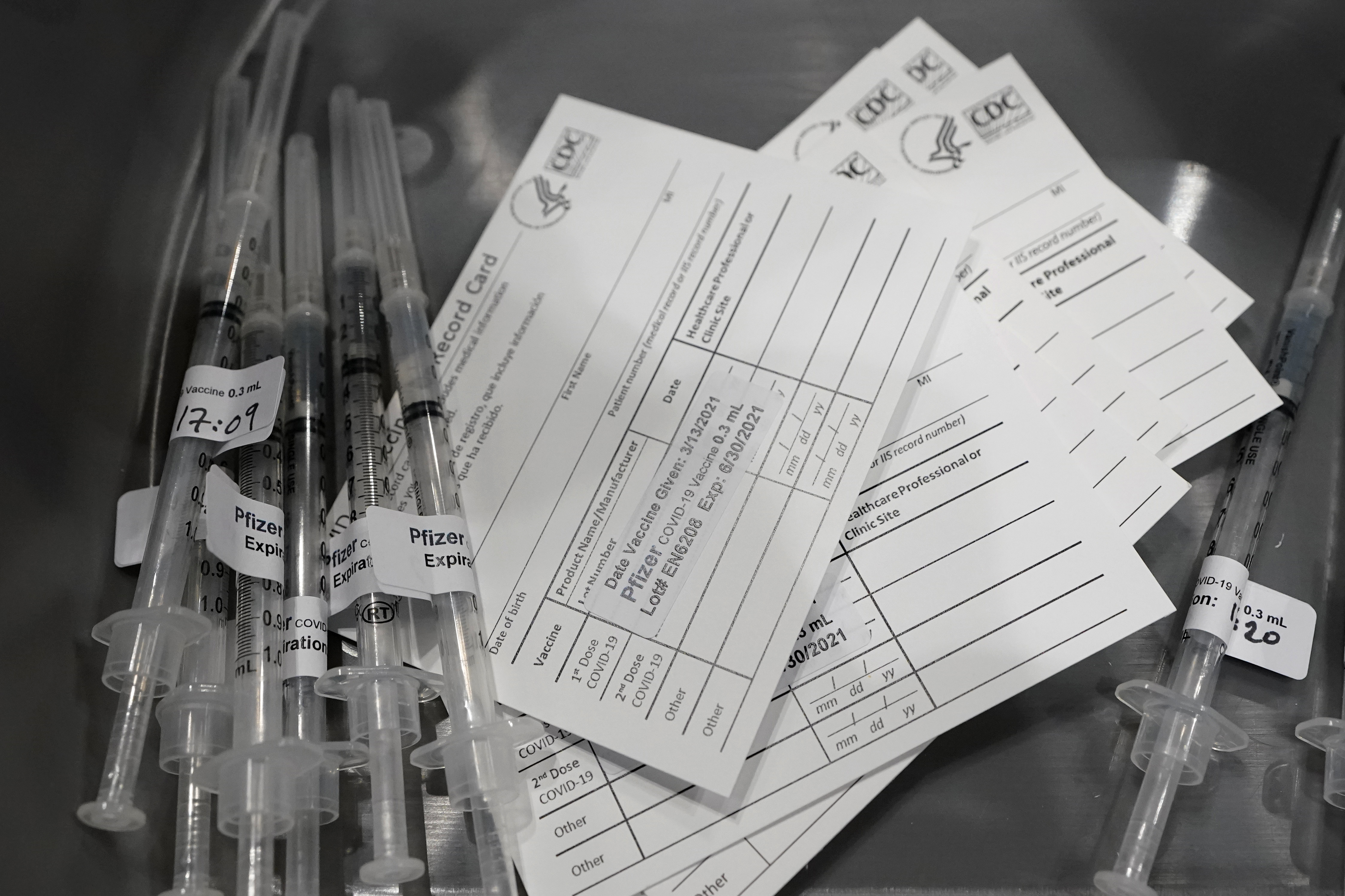

The most recently published data from the Florida Department of Health shows daily case numbers on the rise with no signs of slowing down, despite millions of Americans being vaccinated.

Florida data does not show specific numbers for each variant of COVID-19, but many medical experts are concerned with the spread of the delta variant across the country’s unvaccinated population.

The Centers for Disease Control and Prevention reports that 163.9 million Americans are fully vaccinated. Roughly 42.3% have received the first dose or not been vaccinated, collectively.

Florida’s vaccinations per week continue to decline, with the previous week’s report showing that only 245,954 doses were administered as of July 16, compared to the 769,402 administered as of May 14.

Florida’s eviction risk

According to the Census HPS, hundreds of thousands of Floridians are worried about staying in their homes due to economic issues created by the COVID-19 pandemic. All of them could potentially be approved for assistance from Emergency Rental Assistance Program funding, but connecting residents to the funds has proven difficult.

As of February 2021, all $25 billion in funding allocated by the first round of emergency rental assistance (ERA1) was distributed to state, local, and Tribal governments by the Treasury Department. An additional $8.6 billion had been added in early May by the American Rescue Plan (ERA2).

The White House and President Joe Biden have turned their efforts from extending the moratorium on evictions to producing information campaigns to connect more residents with Emergency Rental Assistance.

In Hillsborough County, the number of evictions filed in court is rising, with 656 filed in July versus the 634 in June. Year over year, July 2020 had 155 evictions, showing a dramatic drop from April to July after the eviction moratorium was instituted in March at the start of the pandemic.

8 On Your Side has reached out to other local counties to get the eviction numbers across Tampa Bay as the moratorium ends.

Still, with emergency assistance programs ramping up, applicants looking to receive the funds need to hit a couple of different benchmarks to be approved.

For assistance to be awarded, residents must be unemployed due to COVID-19, have experienced reductions in household income, faced high costs due to the pandemic, or experienced financial hardships due to the virus.

The applicants must also demonstrate a risk of experiencing homelessness without assistance. Eligible tenants must have a household income at or below 80% of the Area Median Income for their community.

Once awarded, the funds can be used on expenses such as rent, rental arrears including late fees, or utility arrears.

Assistance in Florida, Tampa Bay

Meanwhile in Florida, the state’s $871.2 million in ERA1 funds had only served $100,000 as of May 31, according to a federal ERA Compliance Report produced and published by the Department of the Treasury.

Local governments received a separate chunk of the federal relief money, totaling $570 million. The latest compliance report shows $62.2 million had been distributed by local governments and programs as of May 31.

In Sarasota County, local leaders received $13.1 million in assistance funds from ERA1 and $4,148,881 from ERA2, from the Coronavirus Response and Relief Supplemental Appropriations Act and the American Rescue Plan, respectively, according to county officials.

According to a county official, an additional $10.2 million has been awarded to Sarasota County from ERAP 2, as of July 27.

From a release by Sarasota County on July 29, the county had disbursed $1,095,284 to 180 households. The release notes that 691 applications had been submitted to the program, and 4,185 calls had been answered since applications launched.

In St. Petersburg, $8 million was given to fund the city’s ERAP efforts. As of June 30, city officials say they had spent $1,231,067.22 in assistance, with another $151,879.69 waiting to be disbursed. 668 rental payments had been made as of June 30, according to documents from St. Petersburg.

In Pinellas County, $20.4 million was funded for ERAP, with 730 applicants approved to date and $5.2 million awarded. The tracker from Pinellas County on relief funding says the figures published are accurate as of July 1.

Pasco County received $27.3 million in direct assistance funding for mortgage, rent and utilities programs. County officials say $16.7 million is being distributed through the Pasco H.E.A.R.T. program, while $8 million was distributed through Pasco CARES and $2.6 million was distributed through the county’s SHIP-CRF program.

As of July 27, Pasco H.E.A.R.T. has distributed $4.47 million. 2,111 applications for assistance have been submitted, 846 were completed, 396 applications are in progress, and 869 did not meet qualifying guidelines, officials say. The county says Pasco H.E.A.R.T. partner agencies have received 762 submitted applications, with 562 completed and 206 denied.

Pasco CARES received 3,804 application submissions, with 2,804 approved, while SHIP-CRF received 763 submissions, and 471 were approved.

According to officials, the American Rescue Plan approved $107,597,711 for Pasco County, of which half was received in May, and the next half is expected for receipt in 2022. County officials told 8 On Your Side that they have not yet developed a spending strategy for the ARP funding and are still awaiting final guidance from the Treasury on guidelines.

On July 30, Polk County said $17 million was allocated for ERAP by the Polk Board of County Commissioners. From June 1 to Aug. 13, applications by Polk County residents are open for assistance. The county extended its application deadline from Aug. 3 to Aug. 13.

Residents will receive up to $12,000 in assistance directly to landlords, property management or utility companies on their behalf, should they qualify for assistance.

The federal compliance report shows that Polk County received $21.9 million from the federal government for ERA funding. As of May 31, 135 households had been helped, according to the compliance report.

Manatee County received $12.2 million in funding, according to the compliance report from the Treasury Department. County officials tell 8 On Your Side that as of July 29, $2,455,272 has been approved for payment and disbursed to 403 approved applicants.

Overall, 852 applications have been submitted to the program in Manatee County and 295 have been rejected.

According to officials, Manatee County will receive $78.2 million in ARP funds, with the county commissioners discussing how those funds will be allocated later this summer.

Hillsborough County officials say they have received $44 million in rental and utility assistance funds, and $13.5 million has been obligated as of July 21. The county says their program metrics “represent both the City of Tampa” as well as the overall county, whether or not it is another city, or an unincorporated area.

Hillsborough officials from the Social Devices department and the Management and Budget Department say that 4,334 applications were approved. So far, 5,200 applicants have been denied, and another 882 applications were under review as of June 18.

To learn more about what rental, mortgage or utility assistance programs are available, head online to the Department of the Treasury to find help near you.