TAMPA, Fla. (WFLA) — For homeowners hit by Hurricane Ian, federally-backed mortgage company Freddie Mac put out a statement detailing their forbearance options to help with getting back on their feet after the storm. Those who apply can qualify for short-term relief, up to a year without late fees or penalties on their mortgages after the storm.

Now that Florida’s Major Disaster Declaration request was approved, then expanded, to cover the counties hit by Hurricane Ian as it swept through the state, there are multiple disaster relief options both federally and from the state.

Freddie Mac said homeowners with their residences or businesses and places of work that are inside the Presidentially-Declared Major Disaster Area are able to get individual assistance, and that foreclosures and other legal proceedings involving homes are suspended while they seek forbearance plans.

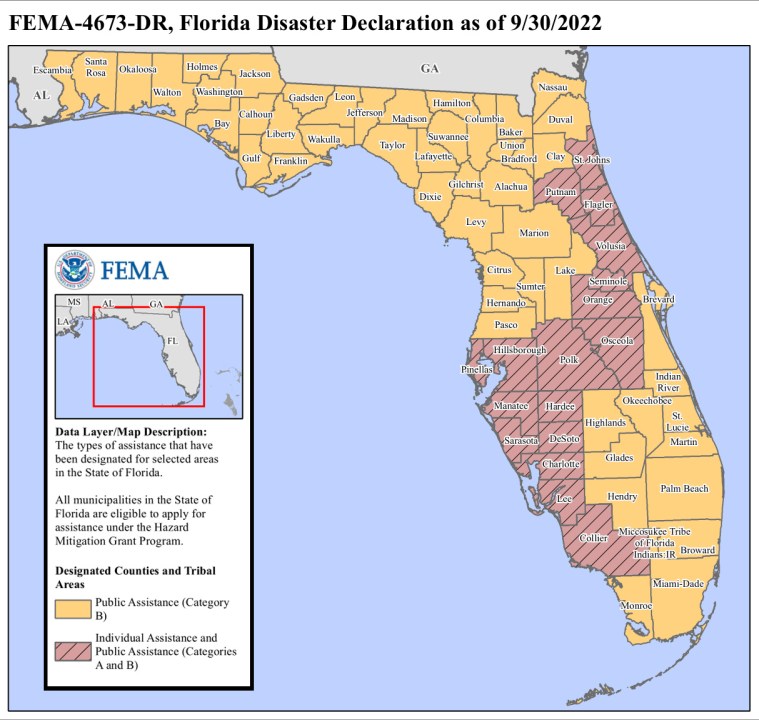

The area included in the disaster declaration spans multiple counties, all impacted by Hurricane Ian after it made landfall in southwest Florida. Counties included in the disaster area are Charlotte, Collier, DeSoto, Flagler, Hardee, Hillsborough, Lee, Manatee, Orange, Osceola, Pinellas, Polk, Putnam, Sarasota, Seminole, St. Johns, and Volusia counties.

The rest of Florida was included, in a limited capacity, for Public Assistance B, which covers emergency protective measures. The disaster area counties also are eligible for debris removal coverage by the federal government so long as it occurs within the next six months.

“As Floridians and other homeowners in southeastern states prepare for Hurricane Ian, it’s important they have their critical documents in order, including their mortgage loan and home insurance policy numbers,” Bill Maguire, Freddie Mac’s Vice President of Single-Family Servicing Portfolio Management, said. “We are also reminding our Servicers that our immediate mortgage relief options are available to support affected homeowners in the path of Hurricane Ian.”

Maguire noted the options were also available to those in Puerto Rico recovering from Hurricane Fiona. Once safe from the impact zones, Freddie Mac said homeowners should get in touch with their mortgage services to talk about relief options. Once “back on their feet,” Freddie Mac said homeowners have a few ways to make up missed payments, and possibly receive additional forbearance.

Freddie Mac listed the relief options as:

- Reinstatement. The option for a lump sum payment is available, but never required, if the homeowner’s loan is owned by Freddie Mac. If possible, however, it is the fastest way to get back on track.

- Repayment plan. Homeowners pay more each month on top of their existing mortgage payment to make up the missed payments.

- Payment Deferral. This option is available if homeowners can resume making their regular monthly payment. With payment deferral, homeowners become immediately current on their mortgage and missed payments are added to the end of the mortgage term without interest or penalties.

- Loan modification. If a homeowner is facing a long-term financial hardship but can make a reduced mortgage payment, a modification may be the best option.

The company said “disaster relief options are available to affected homeowners outside the declared disaster areas if their home incurs a disaster-related insured loss that impacts their ability to make their mortgage payment.”