TALLAHASSEE, Fla. (Cap News Services) More than five million people have filed for unemployment benefits in Florida.

The new unemployment milestone comes as Florida employers begin the new year with higher taxes to cover unemployment benefits.

Florida employers were sent a notice about the increase from the State Department of Revenue. It let them know their cost of doing business will increase in order to help replenish the state’s reemployment trust fund.

Businesses could see their rate go from one tenth of a percent to nearly three tenths of a percent on the first $7,000 in wages.

“Any payroll-based tax increase is not good for the small business climate,” Bill Herrle with the National Federation of Small Business said.

While no hike is ideal, the increase will keep Florida’s fund stable, according to Herrle.

“Business owners are the sole payers into the unemployment system, so they have a strong stake hold in making sure we continue to pay benefits, and we don’t get into a very high debt that will cause rates to go up even higher,” Herrle said.

Unlike the 2008 recession, when Florida had to borrow $2.7 billion to pay unemployment claims, this year the fund is solvent and above water.

In a catch 22, many businesses are having trouble hiring such as the Goodwill of the Big Bend who can’t fill vacancies.

“We have anywhere from forty to sixty jobs postings at all times, so we are constantly in the market looking for qualified employees,” said Goodwill Industries of the Big Bend CEO Fred Shelfer.

The new round of stimulus and unemployment payments will likely push more people out of the job market, putting pressure on companies to pay more to fill vacancies.

The maximum reemployment tax rate for employers with poor records remains at 5.4 percent of the first $7,000 in wages.

LATEST ON THE CORONAVIRUS PANDEMIC:

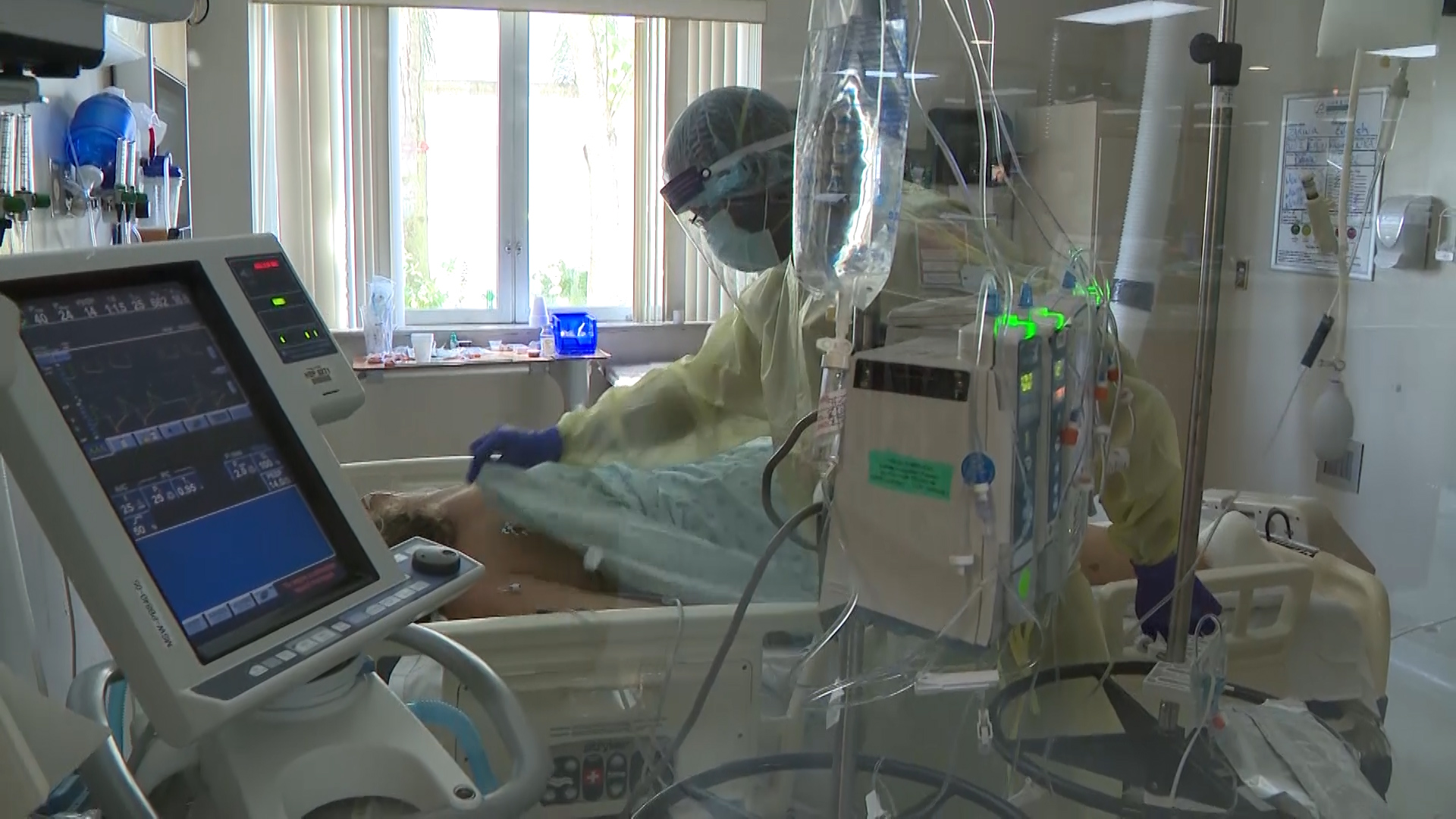

- Going against FDA, Florida Surgeon General discourages use of mRNA COVID vaccines

- Lakeland Regional Health sees COVID-19 and flu cases double over the holidays

- Cruise passengers win class action lawsuit against Carnival after deadly COVID outbreak

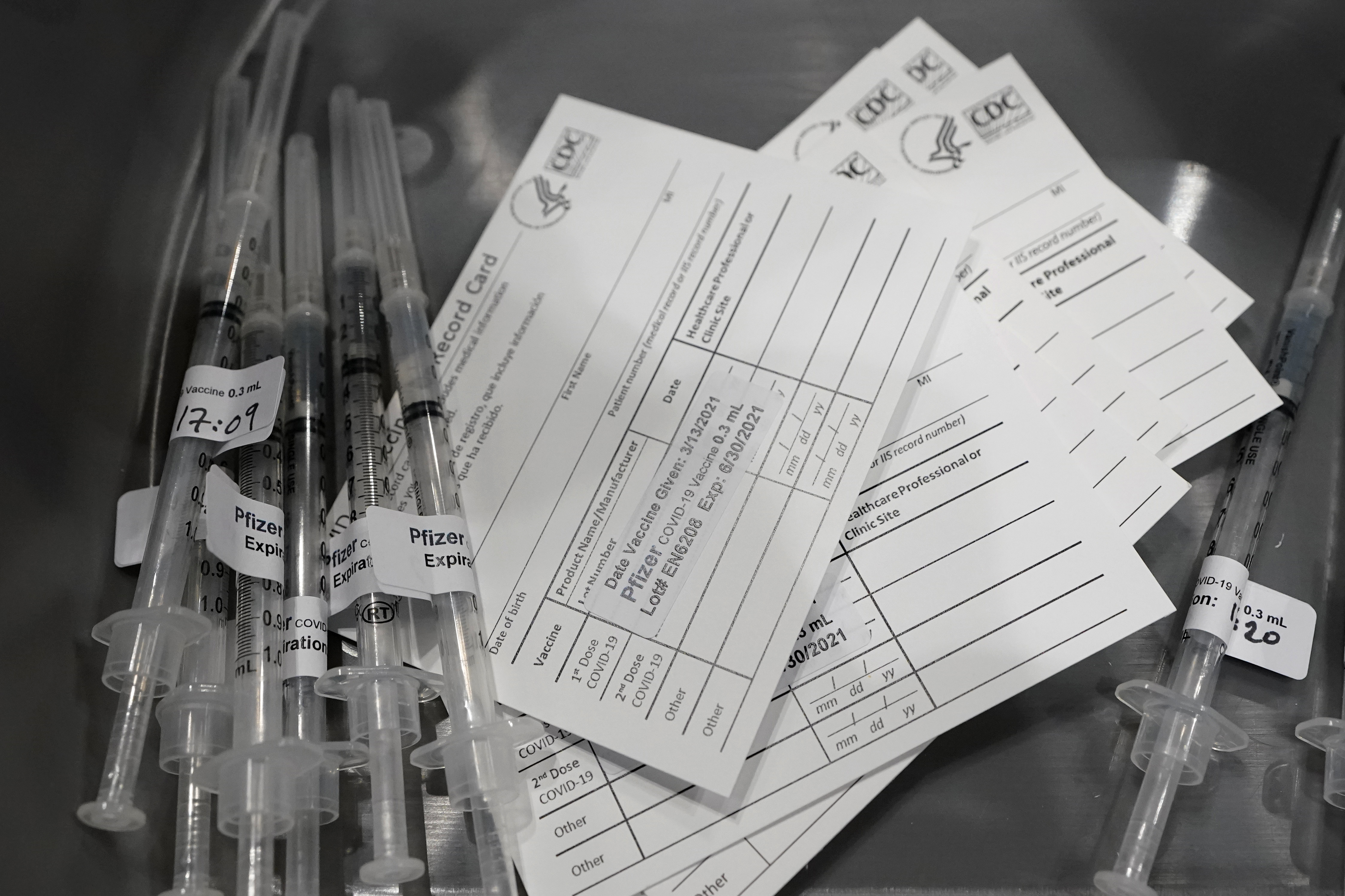

- Say goodbye to the COVID vaccine card: The CDC has stopped printing them

- COVID conspiracies return in force, just in time for 2024