TAMPA, Fla. (WFLA) – A new report is pointing out a glaring disparity between car insurance premiums in Florida and car insurance premiums in other states.

Personal finance website WalletHub analyzed insurance quotes from the websites of the five largest providers in Florida, representing 68 percent of the market. What they found was that the drivers who traveled Florida’s more than 267,000 lane miles are paying an average of nearly $2,500 in car insurance annually.

It’s no surprise Floridians are dealing with mounting car insurance costs. The state has the 19th-highest driving-related deaths. It also has the highest rate of uninsured drivers in the country – 26.7 percent, according to the Insurance Research Council.

Some factors are well-known and play an obvious role in car insurance premiums in Florida. According to the report, 16-year-olds pay 342 percent more than 56-year-olds. It makes sense, considering the amount of driving experience.

But some factors are less obvious. Unmarried drivers could pay up to 2 percent more than married drivers in Florida. And women are paying an average of 7 percent more for car insurance than their male counterparts.

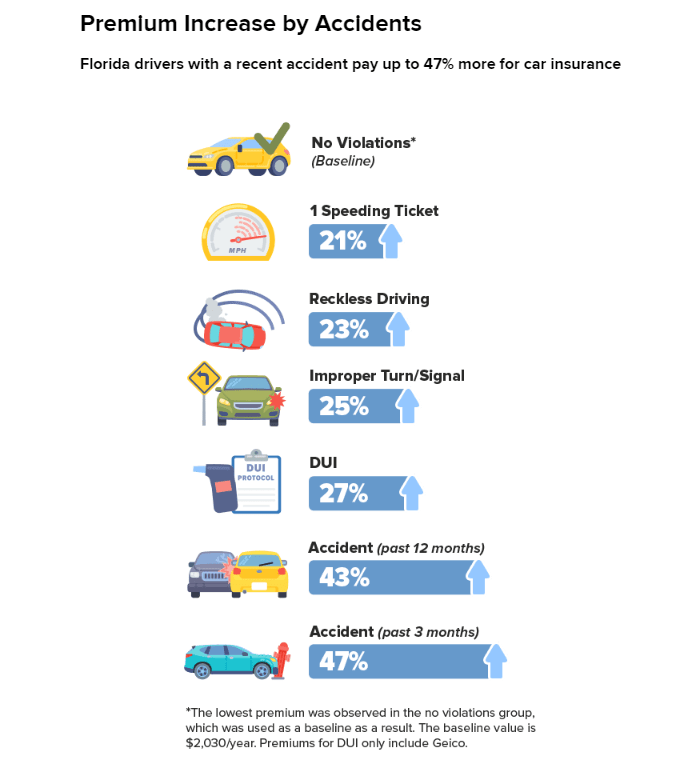

According to WalletHub’s report,Florida drivers with a recent accident – within three months – can see an increase of up to 47 percent more for car insurance. An accident within the past year can bump up insurance rates 43 percent.

Luckily, some Tampa Bay cities have the lowest insurance rates in the state.

While Gainesville residents have the lowest average car insurance premiums, Sarasota residents are paying the fifth-lowest. Tampa and St. Petersburg residents also have relatively low rates.

“Florida drivers should try to take advantage of discounts to make their car insurance cheaper,” WalletHub analyst Jill Gonzalez said. “You should be able to get discounts if you’re a veteran, have a good driving record, bundle policies or have an anti-theft system, just to name a few things. You can also choose a higher deductible, which can save you money if you never have an accident. Just make sure it doesn’t cause a financial burden if you go with this option.”