TAMPA, Fla. (WFLA) — Florida’s back-to-school sales tax holiday returned on Saturday, July 31, meaning parents can save on a variety of school supplies, clothing and other items.

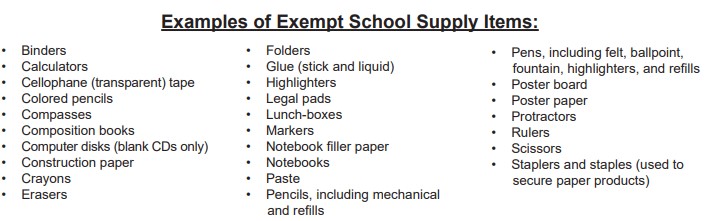

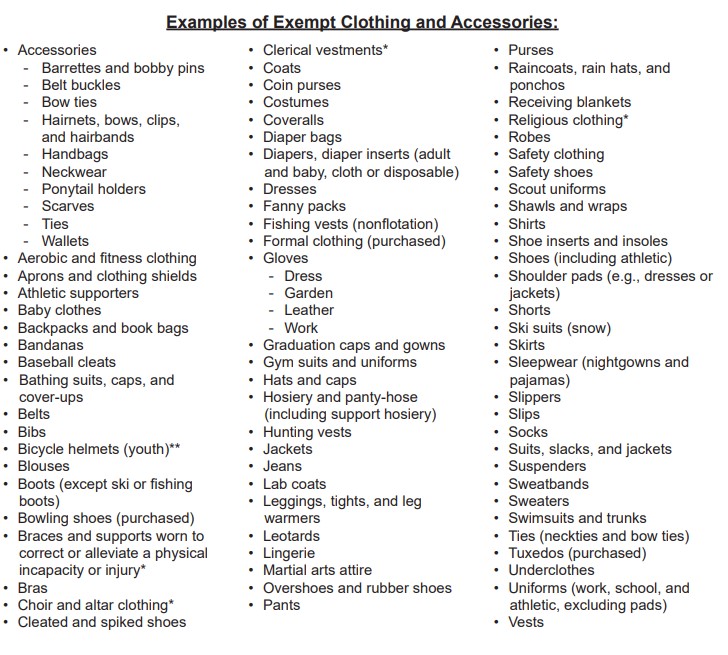

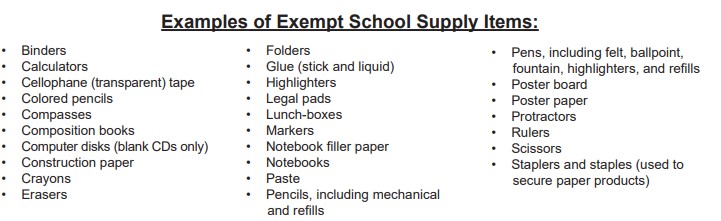

School supplies for $15 or less, clothing purchases of $60 or less per item and the first $1,000 of computers and accessories are exempt from state and local taxes during the holiday, which runs from Saturday, July 31 to Monday, Aug. 9.

The sales tax holiday will not apply to:

• Any item of clothing selling for more than $60;

• Any school supply item selling for more than $15;

• Books that are not otherwise exempt;

• Computers and computer-related accessories purchased for commercial purposes;

• Rentals or leases of any eligible items;

• Repairs or alterations of any eligible items; or

• Sales of any eligible items in a theme park, entertainment complex, public lodging establishment, or airport.

The Florida Retail Federation said the average family was expected to spend up to $900 in school supplies this year. They said during the holiday, Floridians will save an estimated $69.4 million in taxes.

Here are some examples of items that are exempt from taxes during the holiday:

“So we’re definitely seeing more people that are going to be shopping online and we understand that. And we encourage that if you do shop online, shop with a retailer that invests in your community. We use the term ‘find it in Florida’. There’s a lot of retailers large and small that invest in Florida, hire Floridians, and pay taxes in Florida. So if you do shop online, try and shop with one of them and support your local community,” said Federation President Scott Shaley.

Between the back-to-school, hurricane, and freedom week holidays Floridians are expected to avoid a grand total of $168 million in sales tax this year.