PASCO COUNTY, Fla. (WFLA) – With billions in fraudulent pandemic disaster relief loans handed out across the state and country, the owners of a Pasco County micro-farm figured their legitimate request for a mere $18,000 would fly through the process.

But while Cannapalooza Farms owners Marlon Santiago and Rudy Fiordilino waited for the loan, they became especially irked after seeing 8 On Your Side reports about dozens of phony farm loans taken out in the names of unknowing Tampa Bay area residents who were victims of widespread identity theft.

William Dreyer had no idea he was named as the proprietor of Dreyer Farms, purportedly planted in his South Tampa yard.

“I’ve lived here nearly 50 years and never picked up a hoe,” Dreyer said when contacted by 8 On Your Side in January.

Santiago and Fiordilino were optimistic about their year-old Cannapalooza hemp operation until the pandemic broke the nation’s shipping and distribution chain and cut them off from their customers.

They said they believed the SBA loan would help them stay afloat but by early May, the farmers were frustrated by the process.

“I’ve been trying to get this done for six months,” Santiago said back then. “We are at our wits end here.”

Fiordilino did not hesitate when asked if Cannapalooza was close to going out of business.

“Yes,” he said. “We were.”

This week, nine months after their application was submitted and following several emails to the SBA from 8 On Your Side and Cannapalooza, they finally got results.

A sale involving 300 plants fell through during the wait but now the loan has been approved and funded, helping the farm survive and expand.

“It was pure excitement,” Fiordilino said. “We actually said, ‘Wow! They got it right.’ “

Still, these small business owners empathize with others who did not survive the delays.

“Marlon and I put everything into [this farm] but we have other jobs to help us make it through,” Fiordilino said. “Those small businesses out there? This is all they’re doing, and they haven’t gotten anything.”

“If you hadn’t reached out to us, I think we’d still be waiting for the money,” Fiordilino added. “I think shedding some light on this is what put it over the finish line.”

The SBA has not commented on how many loans have been delayed or what caused the issues. For Cannapalooza the glitches included SBA typos, lost paperwork and slow response times to questions.

One example, according to Santiago, was the agency’s repeated request for the 4506-T form that allows the SBA to ask the IRS about tax filings.

“They have asked for the 4506-T form from me at least half a dozen times,” Santiago said.

Getting someone on the phone happened from time to time, but with minimal impact.

“People we’ve talked to either can’t help us or don’t know what we’re talking about,” Fiordilino said.

In an email earlier this year, the SBA apologized for “technical issues” but did not go into detail.

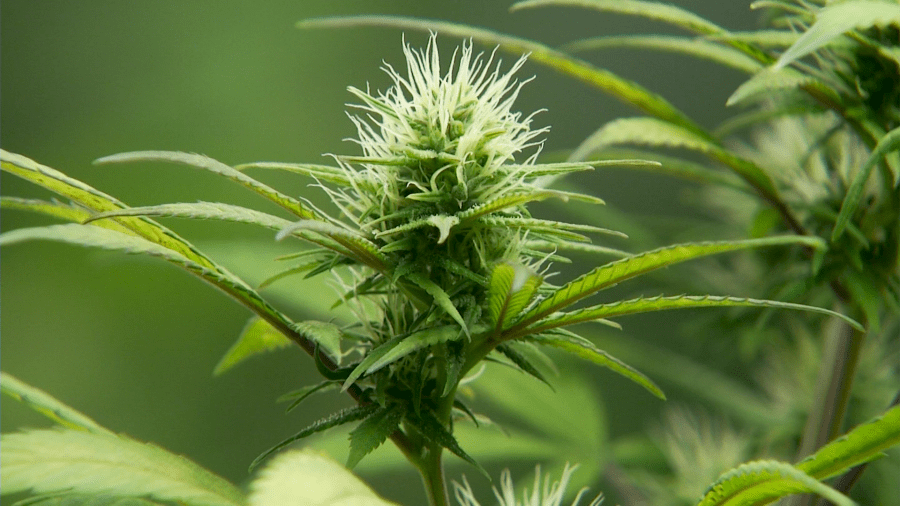

The partners never suspected Cannapalooza’s crop contributed to delays because hemp is legal under federal law. Unlike its cannabis-cousin, hemp has only trace amounts of the psychoactive compound THC, so it does not get the user high.

The 8 On Your Side investigation in February involved culling the Florida disaster loans from an immense SBA spreadsheet of more than three million transactions worth $194 billion that were handed out since last spring across the country.

After pulling the Tampa-based transactions from the state’s list, a second look uncovered dozens of loans to farms that didn’t exist, in the names of Tampa Bay area residents who did not apply.

An SBA Office of Inspector General report expressed concerns about $79 billion worth of loans from the first draw that ended last year.